But a huge part of truly #adulting is knowing how and when to spend your money.

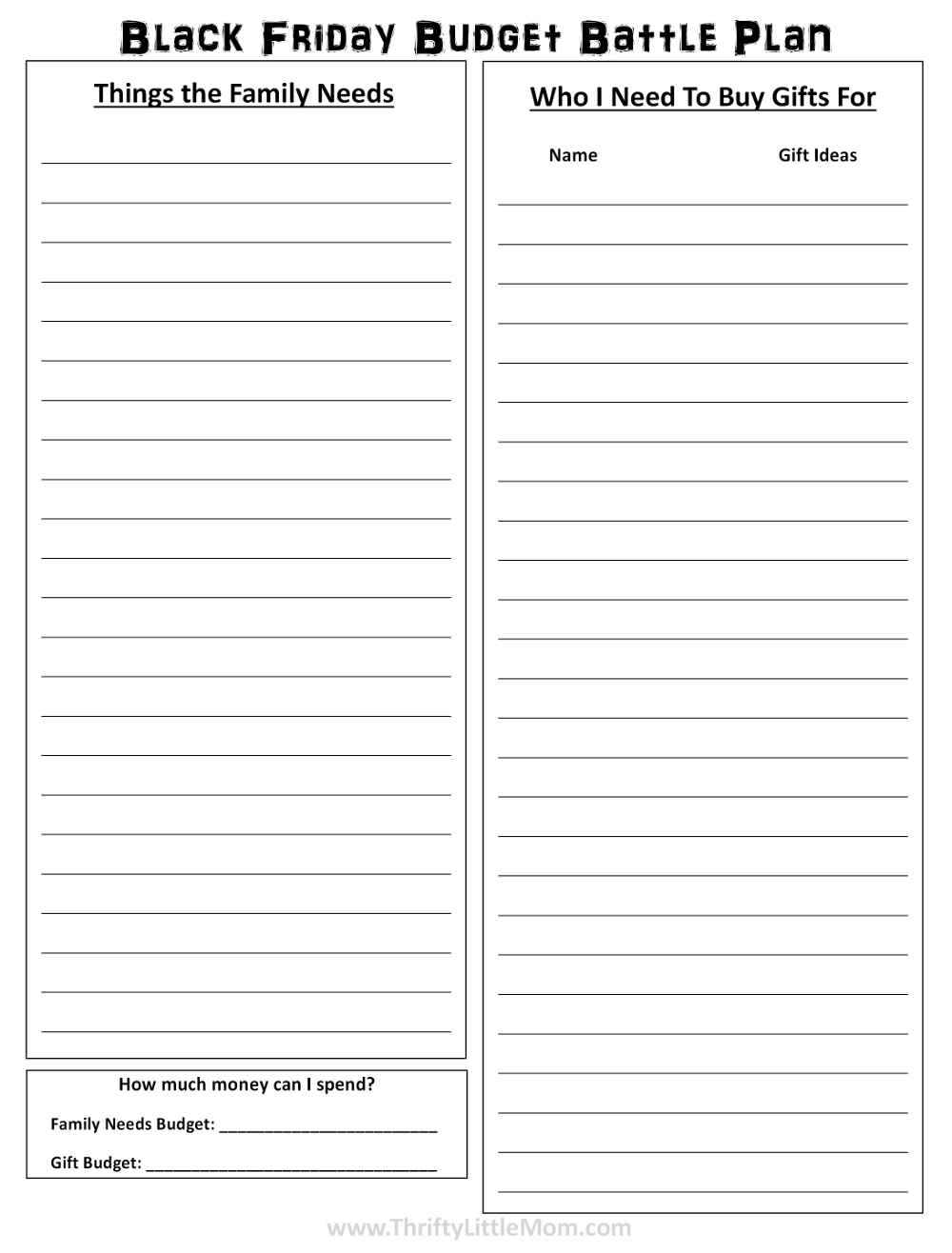

Most of the time, it pays to shop slowly and carefullybut not on Black Friday If you’re going to score the best values at multiple stores, you need to grab the items you want, check out, and head to the next store. That means stashing 50 a month away for holiday spending in December. Knowing exactly what you’re looking for will save hours of wandering and wondering. Add Non-Monthly Costs Take those large, less-frequent expenses (that usually send you into a financial tailspin) and break them into manageable, monthly bills. It can be really difficult to not buy things when they're being offered for so much cheaper than they normally are. You can go back and add it later, and your budget will help you unearth any future additions needed. Outside of being broke, I personally think that Black Friday is a huge exercise in self-control.

But luckily for you, there are a lot of options of things to do instead of going shopping if you're saving your coin for a different day. (Though it's ridiculously tempting to get that cute $200 jacket if it's on sale for $50 - talk about a bargain!) It can be pretty hard to distract yourself from the holiday frenzy going on around you, but there are a few things to do on Black Friday that aren't shopping, if you're broke AF.Īs much as unlimited spending for the season would be a dream come true, the reality is that the holidays can be pretty rough for my fellow #GirlBosses out there who are trying to budget. Black Friday is a double-edged sword: Big savings sound so amazing, but at the same time, you don't really want to spend money.

0 kommentar(er)

0 kommentar(er)